|

1

|

|

|

|

|

MURPHY UNVEILS 2 SWEEPING PLANS TO GET NJ TRANSIT BACK ON THE RIGHT TRACK

|

Friday, June 12, 2020

|

Timothy White

|

|

2

|

|

|

|

|

OP-ED: WE MUST TAKE STOCK OF SCHOOLS’ RESPONSE TO COVID-19

|

Friday, June 12, 2020

|

Timothy White

|

|

3

|

.jpg)

|

|

|

|

MCCABE JOINS SHUFFLER FIRM AS PARTNER

|

Monday, June 8, 2020

|

Timothy White

|

|

4

|

|

|

|

|

N.J. LEGISLATURE PASSES $7.7B STOPGAP BUDGET TO COVER NEXT THREE MONTHS

|

Wednesday, July 1, 2020

|

Timothy White

|

|

5

|

|

|

|

|

ANOTHER SHOT AT ADDRESSING NJ’S CRISIS OF LEAD IN DRINKING WATER

|

Wednesday, July 1, 2020

|

Timothy White

|

|

12

|

|

|

|

|

LAWMAKERS WANT TO COMP RESTAURANT OWNERS WHO LOST MONEY ON INDOOR DINING PREP

|

Saturday, July 18, 2020

|

Timothy White

|

|

13

|

|

.jpg)

|

|

|

OP-ED: CONGRESS NEEDS TO FINISH JOB, HELP NATION REBUILD CRUMBLING SCHOOLS

|

Saturday, July 18, 2020

|

Timothy White

|

|

14

|

|

|

|

|

PLANS UNDERWAY FOR BUILDING MASSIVE OFFSHORE WIND FARMS ALONG JERSEY COAST

|

Thursday, August 27, 2020

|

Timothy White

|

|

15

|

|

|

|

|

SOLAR FARMS ON NJ FARMLANDS? STATE LOOKS TO BOOST LARGE-SCALE PROJECTS

|

Thursday, August 27, 2020

|

Timothy White

|

|

18

|

|

|

|

|

FOR KIPP CHARTERS IN NEWARK AND CAMDEN, SCHOOL STARTS NOW — BUT REMOTELY

|

Thursday, August 27, 2020

|

Timothy White

|

|

19

|

|

|

|

|

SOLAR GRIDS BUILT ON NJ FARMLAND GET SENATE BACKING

|

Thursday, August 27, 2020

|

Timothy White

|

|

20

|

|

|

|

|

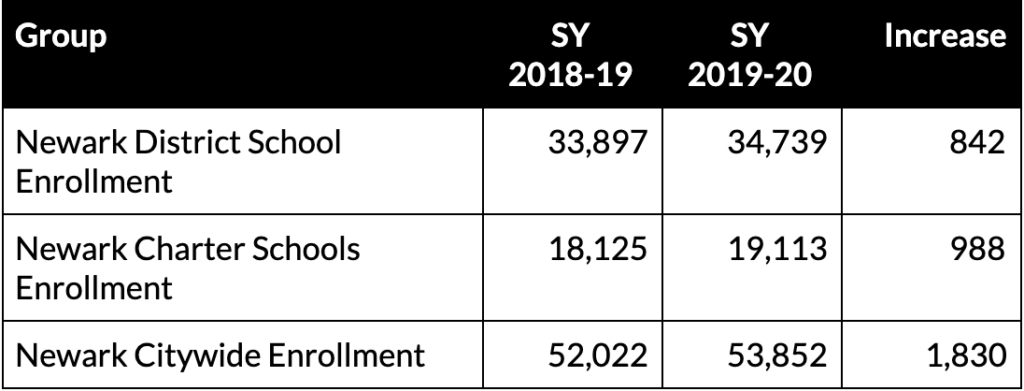

Newark Continues Citywide Public School Enrollment Surge For Fifth Consecutive Year

|

Thursday, September 24, 2020

|

Timothy White

|

|

21

|

|

|

|

|

T.J. Best joins charter school association

|

Wednesday, October 7, 2020

|

Timothy White

|

|

22

|

|

|

|

|

Community solar program gets big push: NJ moves to double the number of projects, clear hurdles for businesses to join

|

Wednesday, October 7, 2020

|

Timothy White

|

|

23

|

|

|

|

|

Amazon’s first brick-and-mortar ‘4-star’ store in N.J. is opening Tuesday

|

Tuesday, October 13, 2020

|

Timothy White

|

|

24

|

|

|

|

|

N.J.'s medical marijuana chief douses senator’s pipe dream of legal weed for sale immediately after the election

|

Friday, October 30, 2020

|

Timothy White

|

|

25

|

|

|

|

|

Legal weed now approved, Murphy names picks for commission to oversee N.J. marijuana industry

|

Friday, November 6, 2020

|

Timothy White

|

|

26

|

|

|

|

|

Details, exemptions for N.J.’s new outdoor gathering limit revealed by Gov. Murphy

|

Tuesday, December 1, 2020

|

Timothy White

|

|

27

|

|

|

|

|

Englewood Health named Pandemic Hero of the Year by Leapfrog Group

|

Tuesday, December 8, 2020

|

Timothy White

|

|

28

|

|

|

|

|

North Jersey native tapped by Gov. Phil Murphy to state Supreme Court.

|

Thursday, March 18, 2021

|

Timothy White

|

|

29

|

|

|

|

|

Does your kid need summer school after remote learning? The odds are good, new report says.

|

Tuesday, March 30, 2021

|

Timothy White

|

|

30

|

|

|

|

|

Amazon opens 3 delivery stations in N.J.

|

Tuesday, August 3, 2021

|

Timothy White

|

|

31

|

|

|

|

|

NJBPU Awards 165 MW of Community Solar to 105 Projects in Pilot Year 2

|

Friday, October 29, 2021

|

Timothy White

|

|

32

|

|

|

|

|

Senate’s education leader steps up and moves on

|

Thursday, December 16, 2021

|

Timothy White

|

|

33

|

|

|

|

|

RCSG's Danielle Alpert Named to Save Jersey's Right Women to Watch in 2022 list

|

Tuesday, January 4, 2022

|

Timothy White

|

|

34

|

|

|

|

|

RCSG's Kevin McCabe named Politician of the Year by NJ Globe

|

Tuesday, January 4, 2022

|

Timothy White

|

|

35

|

.jpg)

|

|

|

|

New N.J. Legislature — and new Senate president — sworn in. Some of the many new faces make history.

|

Wednesday, January 12, 2022

|

Timothy White

|

|

36

|

|

.jpg)

|

|

|

Congratulations to RCSG’s Danielle Alpert on this well-deserved recognition - ROI Influencers: Women in Business

|

Thursday, March 24, 2022

|

Timothy White

|

|

37

|

|

|

|

|

NJ is swimming in billions of extra dollars, officials say. The question is how to use it

|

Wednesday, May 18, 2022

|

Timothy White

|

|

38

|

|

|

|

|

‘All eyes on N.J.’ with new push to protect poor and minority communities from pollution

|

Monday, June 13, 2022

|

Timothy White

|

|

39

|

|

|

|

|

Murphy touts ‘historic and direct property tax relief’ as he signs $50.6B N.J. budget

|

Friday, July 1, 2022

|

Timothy White

|

|

40

|

|

|

|

|

New Incentives for Year 3 of Charge Up NJ EV Program

|

Wednesday, August 3, 2022

|

Timothy White

|

|

41

|

|

|

|

|

Developer of Hoboken Hilton Finalizes Land Deal, Sets Construction Timeline

|

Thursday, August 18, 2022

|

Timothy White

|

|

42

|

|

|

|

|

Getting our tax back: Murphy, Legislature offer 3 proposals to fight unfair taxation by other states

|

Wednesday, September 7, 2022

|

Timothy White

|

|

43

|

|

|

|

|

River Crossing Strategy Group promotes Yasmin Brissac to Legislative Associate

|

Wednesday, October 19, 2022

|

Timothy White

|

|

44

|

|

|

|

|

NJ abandons plan to require costly electric boiler upgrades

|

Wednesday, December 14, 2022

|

Timothy White

|

|

45

|

.jpg)

|

|

|

|

RCSG’s Stephanie Albanese Recognized on Sen. Weinberg’s Power List 2023

|

Tuesday, February 14, 2023

|

Timothy White

|

|

46

|

.jpg)

|

|

|

|

Janellen Duffy Joins River Crossing Strategy Group

|

Monday, February 27, 2023

|

Timothy White

|

|

47

|

|

|

|

|

New Client Announcement: New Jersey Symphony

|

Tuesday, March 21, 2023

|

Timothy White

|

|

48

|

|

|

|

|

Murphy Publishes New Environmental Justice Rules

|

Wednesday, April 19, 2023

|

Timothy White

|

|

49

|

|

|

|

|

New Client Announcement: NJ Tutoring Corps., Inc.

|

Tuesday, May 23, 2023

|

Timothy White

|

|

1049

|

|

|

|

|

Murphy, Coughlin, Scutari agree on framework for StayNJ senior tax cut deal

|

Tuesday, June 20, 2023

|

Timothy White

|

|

1050

|

|

|

|

|

Zimmerman replaces Caride at DOBI

|

Wednesday, June 28, 2023

|

Timothy White

|

|

1051

|

|

|

|

|

Natural gas' future is up in the air, but New Jersey isn't banning gas stoves

|

Wednesday, August 2, 2023

|

Timothy White

|

|

1052

|

|

|

|

|

Murphy names Guhl-Sadovy NJBPU president

|

Thursday, September 14, 2023

|

Timothy White

|

|

1053

|

|

|

|

|

Helmy to leave Governor's Office

|

Tuesday, September 19, 2023

|

Timothy White

|

|

1054

|

|

|

|

|

Governor Murphy Names Diane Gutierrez-Scaccetti as Chief of Staff

|

Tuesday, September 26, 2023

|

Timothy White

|

|

1055

|

|

|

|

|

River Crossing Strategy Group Launches New Public Affairs/Communications Practice in Northeast Florida

|

Wednesday, October 11, 2023

|

Timothy White

|

|

1056

|

|

|

|

|

New Jersey lawmakers plan overhaul of affordable housing system

|

Wednesday, December 20, 2023

|

Timothy White

|

|

1057

|

|

|

|

|

Murphy Appoints Francis O’Conner as New DOT Commissioner

|

Tuesday, January 30, 2024

|

Timothy White

|

|

1058

|

|

|

|

|

Gov. Phil Murphy proposes new NJ Transit funding, tax relief in budget address

|

Wednesday, March 6, 2024

|

Timothy White

|

|

1059

|

|

|

|

|

Eric Miller named executive director of Office of Climate Action and the Green Economy

|

Wednesday, March 20, 2024

|

Timothy White

|

|

1060

|

|

|

|

|

RCSG Announces Practice Group Leadership Positions

|

Monday, April 8, 2024

|

Timothy White

|

|

2059

|

|

|

|

|

Murphy Announces Landmark Solar Investments

|

Tuesday, April 30, 2024

|

Timothy White

|

|

2060

|

|

|

|

|

River Crossing Strategy Group welcomes Tyra Gibbs

|

Tuesday, May 7, 2024

|

Timothy White

|

|

2061

|

|

|

|

|

Governor Murphy Announces Departure of Chief of Staff Diane Gutierrez-Scaccetti and Names Tim Hillmann as New Chief of Staff

|

Tuesday, July 16, 2024

|

Timothy White

|